Nigeria’s Economic Outlook for 2026: From Stabilization to Gradual, Inclusive Growth

Posted on Mon 19 January 2026 in Nigeria

Published: January 19, 2026 | N-Circular Economic Analysis

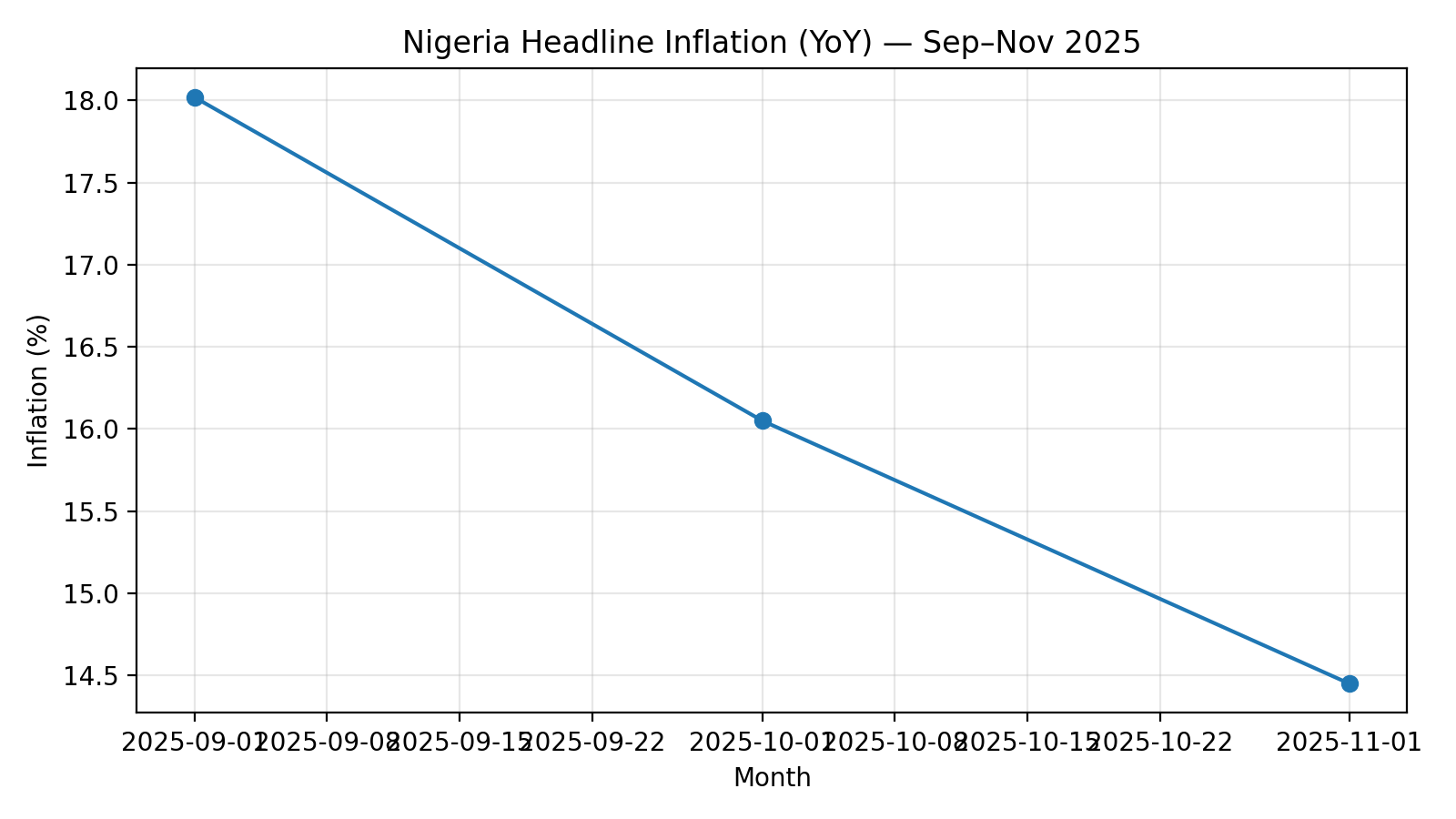

As Nigeria embarks on 2026, the nation's economic landscape presents a picture of cautious optimism tempered by persistent structural challenges. Following President Bola Ahmed Tinubu's administration's ambitious reform agenda implemented throughout 2025, the economy is demonstrating tangible signs of stabilization. Real GDP grew 3.98% y/y in Q3 2025 (National Bureau of Statistics), headline inflation has eased to 14.45% in November 2025 under the rebased CPI, and the naira consolidated gains at the official window in early January 2026. External reserves closed 2025 around $45.5 billion, providing a robust buffer against shocks.

Yet beneath these encouraging headline figures lie complex realities: rising poverty rates affecting nearly two-thirds of Nigerians, oil sector vulnerabilities with production often falling short of targets, and security concerns that threaten to undermine progress. This comprehensive analysis synthesizes insights from leading financial institutions including PwC Nigeria, the International Monetary Fund (IMF), the Central Bank of Nigeria (CBN), Fitch Ratings, and CardinalStone Partners, alongside government policy documents and real-time data from Nigeria's economic indicators.

Macroeconomic Baselines (End-2025 / Early-2026)

Growth Trajectory and Sectoral Performance

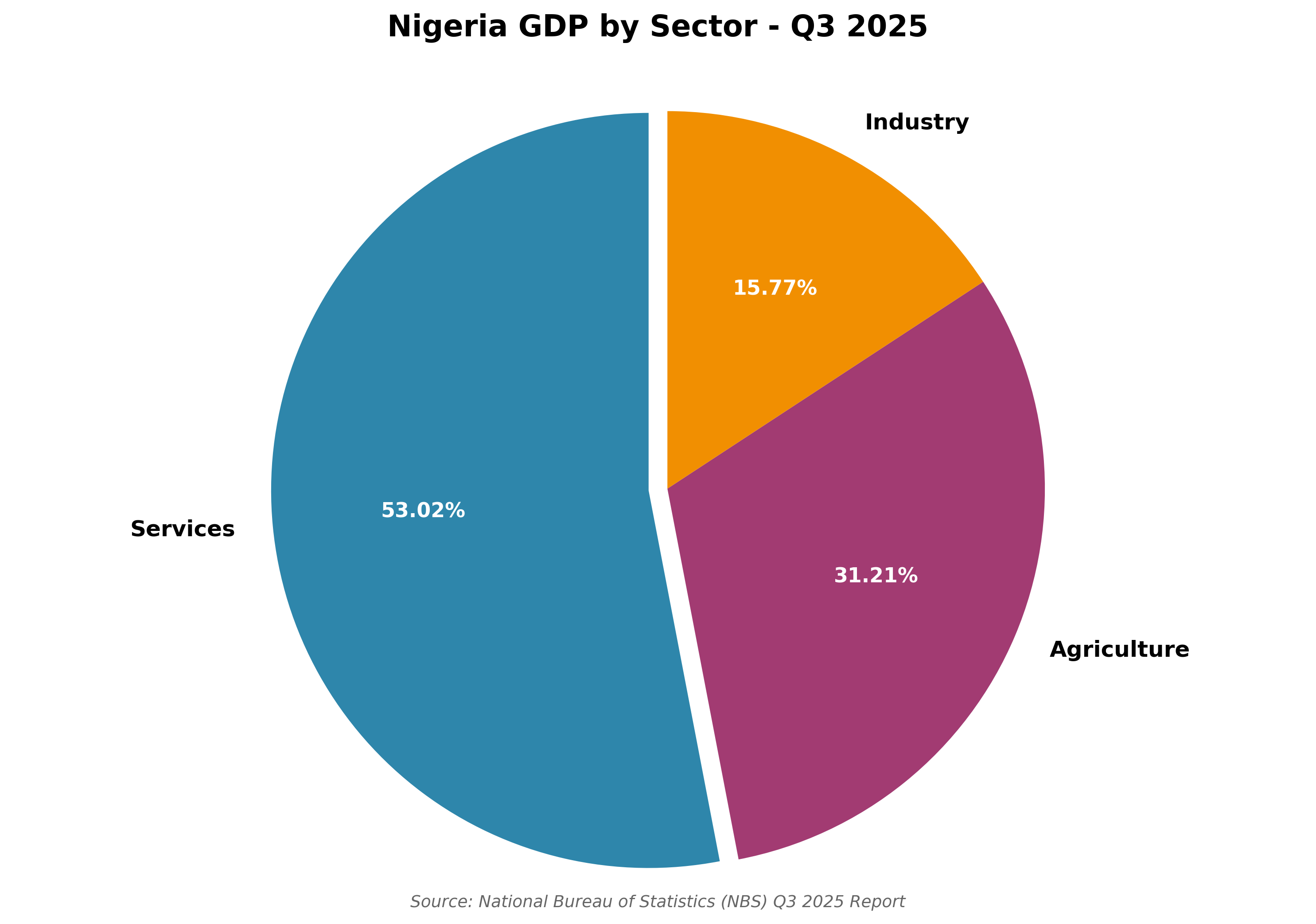

The Nigerian economy is projected to expand by 4.2–4.5% in 2026, representing a modest acceleration from 2025's third-quarter growth rate of 3.98%. The National Bureau of Statistics reports that services led output at 53.02% of GDP in Q3 2025, with agriculture contributing 31.21% and industry 15.77%. Oil production averaged 1.64 million barrels per day (mbpd) in Q3, lifting oil-sector growth to 5.84% y/y.

Major Institutional Forecasts for 2026: - PwC Nigeria: 4.3–4.49% - Central Bank of Nigeria: 4.49% - International Monetary Fund: 4.2% - Fitch Ratings: 4.3%

The anticipated expansion will be predominantly driven by non-oil sectors, which have increasingly become the backbone of Nigerian economic activity. Services, telecommunications, financial services, construction, and trade are expected to lead growth, reflecting the ongoing structural transformation of the economy.

GDP by Sector – Q3 2025

Data shows Services dominating at 53.02%, Agriculture at 31.21%, and Industry at 15.77%. Source: NBS GDP Q3 2025

Agriculture, traditionally a major employer and GDP contributor, faces a more uncertain outlook. Persistent security challenges in key farming regions—particularly in the Middle Belt and parts of the North—continue to disrupt production cycles and supply chains, potentially limiting the sector's contribution to overall growth.

Inflation: The Long Road to Price Stability

Perhaps the most visible success of recent policy interventions has been the dramatic reduction in inflation. After years of accelerating price pressures, inflation fell to 14.45% in November 2025—the lowest reading since 2020. Food inflation was recorded at 11.08% amid improved harvests and FX stability. For 2026, the CBN's Economic Outlook projects average headline inflation around 12.94%, representing further moderation.

Headline Inflation (YoY) – Sep-Nov 2025

Inflation trajectory shows: Sep 2025 at 18.02%, Oct at 16.05%, Nov at 14.45%. Sources: CBN, NBS

Several factors underpin this optimistic inflation outlook:

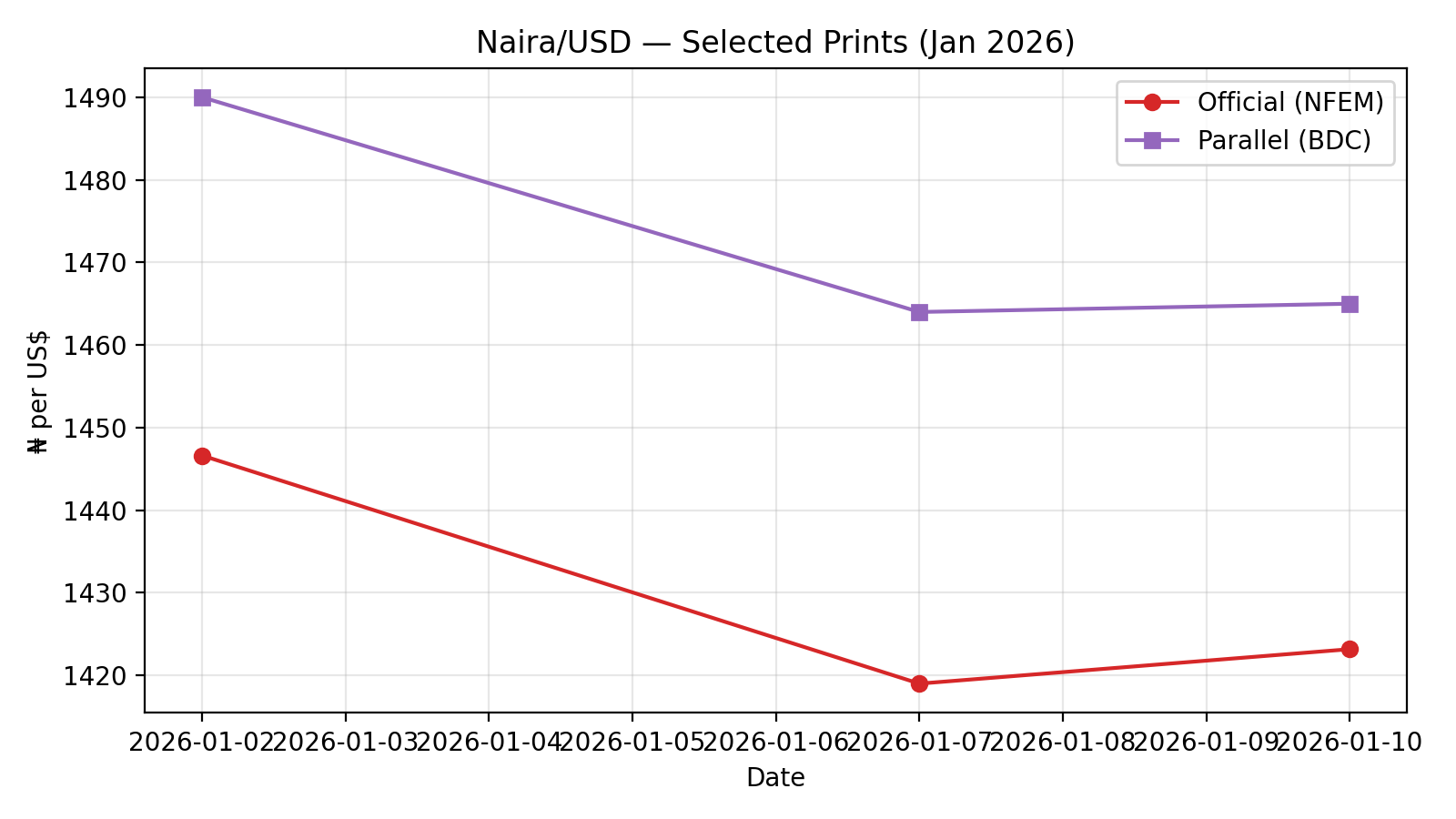

Exchange Rate Stabilization: The naira has found relative equilibrium, trading broadly in the ₦1,420–₦1,450/$ band at the official window in early January 2026, with the parallel spread narrower than mid-2025 as reforms deepened liquidity. This stability has reduced imported inflation that had previously cascaded through the economy.

Food Price Dynamics: Improved harvest seasons, combined with reduced transportation costs following petrol subsidy reforms, are expected to ease food inflation, which comprises a significant portion of the consumer price basket for most Nigerian households.

Monetary Policy Credibility: The CBN's demonstrated commitment to price stability, even at the cost of maintaining relatively tight monetary conditions, has helped anchor inflation expectations among businesses and consumers.

However, risks remain. Pre-election spending ahead of the 2027 general elections could fuel demand-side pressures, while any resurgence in exchange rate volatility or oil price shocks could quickly reverse recent gains.

Exchange Rate Dynamics

The naira traded broadly in the ₦1,420–₦1,450/$ band at the official window in early January 2026. Sample prints show: January 2 at ₦1,446.62/$, January 7 at ₦1,419/$, and January 10 at ₦1,423.17/$. Parallel market rates showed: January 7 at ₦1,464/$, with mid-range prints of ₦1,480–₦1,505/$ on January 9, and approximately ₦1,465/$ on January 10.

The CBN's revised foreign exchange management approach, including greater market determination of rates, has helped eliminate much of the parallel market premium that previously distorted prices.

Naira/USD – Official vs. Parallel (Selected Prints, January 2026)

Chart shows official and parallel market rates converging, with official rates strengthening from ₦1,446 to ₦1,419-₦1,423 range, while parallel market rates hover around ₦1,464-₦1,505. Sources: Multiple market data providers

External Sector: A Surprising Bright Spot

One of the more remarkable turnarounds has occurred in Nigeria's external accounts. External reserves ended 2025 around $45.49 billion, ticking up to approximately $45.6 billion in early January 2026 amid stronger FX inflows and CBN operations. The CBN projects $51.04 billion by end-2026.

External Reserves – Nov 2025 to Jan 2026

Reserves trajectory: Nov 2025 at $44.67bn, Dec at $45.45bn, Jan 7, 2026 at $45.66bn. Sources: CBN, TradingEconomics

CardinalStone Partners projects a current account surplus of $17.7 billion in 2026, representing approximately 4.9% of GDP—a dramatic reversal from the deficits that characterized much of the previous decade. This improvement reflects:

- Increased export earnings from both oil and non-oil sectors, including refined-product exports

- Reduced import pressures due to naira depreciation and economic adjustments

- Growing remittances from the Nigerian diaspora

- Improved foreign direct investment (FDI) flows, which reached $720 million in Q3 2025 alone

This reserve accumulation represents not just a quantitative improvement, but a qualitative shift in Nigeria's external resilience and capacity to weather global economic shocks.

2026 Policy Framework & Budget Signals

Presidential Vision and Budget Priorities

In his 2026 New Year address, President Tinubu highlighted the administration's economic achievements in 2025, framing them as vindication of difficult but necessary reforms. The commemorated milestones included:

- GDP growth exceeding 4% for the first time in several years

- Inflation falling below 15%

- A 48% rally in the Nigerian Stock Exchange, signaling renewed investor confidence

- Significant improvements in foreign direct investment

Appropriation and Fiscal Benchmarks

The President presented a ₦58.46 trillion 2026 Appropriation Bill on December 19, 2025, with a $64.85/barrel oil price benchmark and 1.84 mbpd production assumption. The Senate later endorsed a ₦54.46 trillion framework and lowered the oil benchmark to $60/barrel while retaining production assumptions.

The 2026 federal budget, themed "Restoration: Securing Peace, Rebuilding Prosperity," prioritizes:

- Infrastructure spending to address Nigeria's estimated $3 trillion infrastructure deficit

- Social investment programs aimed at cushioning the impact of reforms on vulnerable populations

- Security funding to address the insurgencies and criminal activities hampering economic activity

- Debt servicing, which continues to consume a significant portion of revenue

CBN Economic Guidance

The CBN 2026 Economic Outlook pencils headline inflation at approximately 12.94% and real GDP growth around 4.49%, conditional on FX/energy stability and reform execution. The central bank also guides toward larger current account surpluses and continued reserve accumulation.

Oil Sector: Progress with Persistent Caveats

Production Realities and Challenges

While the 2026 budget assumes production of 1.84 mbpd, actual performance in 2025 tells a more sobering story. NUPRC and OPEC data show 2025 crude output averaging approximately 1.46–1.50 mbpd (crude), or 1.6–1.66 mbpd including condensates—below the Federal Government's 2025 benchmark and often under the 1.5 mbpd OPEC quota, despite occasional months meeting quota.

The oil sector, while showing signs of gradual recovery, continues to face headwinds from global oversupply, accumulated crude inventories, security challenges affecting production infrastructure, and underinvestment in upstream operations.

Refining and Downstream Developments

The Dangote Refinery represents a transformative development for Nigeria's downstream sector. The facility entered planned maintenance on select units in December 2025 but reaffirmed ongoing supply, indicating 40–50 million litres/day of PMS in January-February 2026, with diesel and jet fuel continuing via other units. Industry coverage notes a short crude distillation unit (CDU) turnaround intended to lift capacity and stabilize the residual fluid catalytic cracking (RFCC) unit.

This development, once fully operational, is expected to significantly reduce Nigeria's refined petroleum product import bill and improve energy security—both critical factors for economic stability and growth.

The 2026 Tax Reforms: A Comprehensive Fiscal Revolution

The Legislative Framework

The centerpiece of Nigeria's economic policy architecture for 2026 is undoubtedly the comprehensive tax reform package that took effect on January 1st. This represents the most significant overhaul of Nigeria's tax system in decades—perhaps since independence. Four landmark pieces of legislation, signed into law in June 2025 after extensive stakeholder consultations, comprise this reform:

1. Nigeria Tax Act 2025: The primary legislation consolidating substantive tax provisions across multiple tax types.

2. Nigeria Tax Administration Act 2025: Establishes modernized procedures for tax assessment, collection, dispute resolution, and enforcement.

3. Nigeria Revenue Service (Establishment) Act 2025: Transforms the Federal Inland Revenue Service into the Nigeria Revenue Service, with enhanced powers, digital capabilities, and a broader mandate.

4. Joint Revenue Board (Establishment) Act 2025: Creates coordination mechanisms between federal and state revenue authorities to eliminate double taxation and improve compliance.

Together, these laws consolidate over 70 previously fragmented taxes, levies, and fees into a streamlined, progressive system. The stated objectives are ambitious but clear:

- Broaden the tax base by bringing more economic activities into the formal system

- Increase the tax-to-GDP ratio from its current ~10% toward the government's 18% target

- Reduce compliance costs for businesses and individuals

- Implement a more equitable distribution of tax burdens

- Deploy technology and data analytics to improve collection efficiency

Personal Income Tax: Relief for the Masses

The most immediately impactful change for ordinary Nigerians is the radical restructuring of personal income tax:

Income Tax-Free Threshold: Annual income up to ₦800,000 (approximately $550 at current exchange rates) is now completely exempt from income tax. This threshold was carefully calibrated to ensure that most low-income workers and minimum wage earners pay no income tax whatsoever. For context, Nigeria's minimum wage is ₦70,000 monthly, translating to ₦840,000 annually—meaning even minimum wage earners receive substantial relief.

Progressive Rate Structure: Beyond the tax-free threshold, a new progressive rate structure applies: - ₦800,001 to ₦3,000,000: 15% - ₦3,000,001 to ₦10,000,000: 18% - ₦10,000,001 to ₦20,000,000: 21% - Above ₦20,000,000: 25%

This structure ensures that the tax burden increases gradually as income rises, implementing a more equitable system where higher earners contribute proportionally more.

Elimination of Nuisance Taxes: Multiple small levies that previously plagued low-income workers—including the radio and television license fee, bicycle and cart licenses, and various informal sector levies—have been abolished entirely. These "nuisance taxes" were costly to collect, yielded minimal revenue, and created harassment opportunities.

The reforms also standardize personal relief allowances, introduce tax credits for pension contributions and life insurance premiums, and simplify filing requirements for individual taxpayers.

Corporate Taxation: Simplification Meets Modernization

Corporate Income Tax Rationalization: The standard corporate income tax rate is harmonized at 25% for large companies (turnover above ₦25 million), with reduced rates for small and medium enterprises: - Small companies (turnover ₦0–₦25 million): 0% - Medium companies (turnover ₦25–₦100 million): 20% - Large companies (turnover above ₦100 million): 25%

This tiered approach aims to support SME growth while maintaining competitiveness with regional peers.

Abolition of Multiple Taxes: Companies previously navigated a bewildering maze of overlapping taxes. The reforms eliminate or consolidate numerous levies including the Education Tax (replaced by a skills development levy), multiple state and local government taxes that effectively constituted double taxation, and various sector-specific levies.

Incentives for Priority Sectors: Generous tax holidays and incentives are preserved for investments in infrastructure, solid minerals, manufacturing, agriculture, and renewable energy. However, these incentives are now time-bound with clear sunset provisions and performance conditions.

Transfer Pricing and International Standards: Nigeria now fully aligns with OECD Base Erosion and Profit Shifting (BEPS) guidelines, including Country-by-Country reporting for multinational enterprises. This modernization aims to curb profit shifting while providing clarity for legitimate international businesses.

Capital Allowances: The reforms introduce accelerated capital allowances for investments in plant, machinery, and technology, encouraging productive investment over mere financial engineering.

Value Added Tax: Broadening the Base

Rate Structure: VAT remains at 7.5% standard rate, with: - 0% rate for essential goods (basic foods, medicines, educational materials) - Exemptions for certain services (health, education, financial services) - Full VAT on luxury goods and services

Administration Improvements: The reforms digitize VAT collection and remittance, with electronic invoicing becoming mandatory for VAT-registered businesses above certain thresholds. This digital infrastructure aims to reduce leakage and improve compliance while lowering the burden on compliant taxpayers.

Revenue Sharing Formula: A contentious political issue, the VAT revenue allocation formula has been adjusted to give greater weight to derivation (where consumption occurs) while maintaining solidarity elements. This change favors economically vibrant states but includes safeguards for less developed regions.

Special Regimes and Sector-Specific Provisions

Petroleum Profits Tax: The reforms maintain the existing Petroleum Profits Tax regime but introduce clearer transfer pricing rules and thin capitalization provisions specific to the oil and gas sector.

Capital Gains Tax: Previously sporadic and inconsistently applied, CGT is now comprehensive but with exemptions for: - Disposal of Nigerian government securities - Shares traded on the Nigerian Stock Exchange (subject to conditions) - Principal private residences - Agricultural land

The rate structure is progressive, ranging from 10% to 15% depending on the nature and holding period of the asset.

Stamp Duties: Electronic stamping for all instruments subject to stamp duty is now mandatory, eliminating the physical stamp regime. Rates are standardized and reduced for many transaction types, particularly affecting banking and finance.

Withholding Tax: The multitude of WHT provisions across various laws has been consolidated. Key changes include standardization of rates, introduction of a withholding tax credit system to prevent cascading, and expansion of final withholding tax provisions for small businesses and individuals.

Implementation and Compliance Architecture

Digital Infrastructure: The Nigeria Revenue Service is rolling out a comprehensive digital tax system including: - Taxpayer portal for registration, filing, and payment - Automated risk assessment and audit selection - Electronic invoicing for VAT - Real-time data integration with banks, mobile money operators, and other third parties

Taxpayer Services: Recognizing that voluntary compliance requires good service, the reforms mandate service standards including maximum processing times for refunds, dedicated SME support units, and alternative dispute resolution mechanisms to reduce litigation.

Penalties and Enforcement: While the reforms aim to make compliance easier, they simultaneously toughen penalties for non-compliance and introduce beneficial ownership disclosure requirements to combat tax evasion.

Critical Risk Factors and Challenges

Oil Price and Production Vulnerabilities

The budget's assumption of $60/barrel oil price (Senate benchmark) faces significant downside risks. Global oil markets in early 2026 are characterized by:

- Substantial crude inventory overhangs

- OPEC+ production discipline challenges

- Accelerating global energy transition reducing long-term demand

- Geopolitical uncertainties that could swing prices in either direction

More critically, Nigeria's ability to reach the 1.84 mbpd production target remains highly uncertain given the actual 2025 average of 1.46–1.50 mbpd. Shortfalls in either price or production would directly impact government revenues and external sector balances.

Security Challenges

Nigeria continues to grapple with multiple security threats across different regions:

- Northeast: Boko Haram and ISWAP insurgencies, though weakened, remain active

- Northwest: Banditry, kidnapping, and cattle rustling disrupt agriculture and commerce

- Southeast: Separatist agitations and criminal violence

- Middle Belt: Farmer-herder conflicts over land and resources

- South-South: Oil theft and pipeline vandalism

These security challenges directly constrain economic activity by disrupting farming, deterring investment, damaging infrastructure, and diverting public resources from productive uses to security expenditure.

Implementation Capacity

Even excellent policies fail without effective implementation. Nigeria's public sector faces capacity constraints at all levels:

- Human capital: Shortages of skilled personnel in key agencies

- Digital infrastructure: While improving, still faces reliability issues

- Coordination: Federal, state, and local government coordination remains challenging

- Corruption: Despite progress, corruption continues to undermine policy effectiveness

The tax reforms, in particular, depend heavily on administrative capacity, technological infrastructure, and voluntary compliance—all of which require sustained investment and institution-building.

Social Pressures and Political Economy

With nearly 63% of Nigerians living below the poverty line (World Bank 2024 data), the gap between macroeconomic improvements and lived experiences creates political tensions:

Cost of Living: Despite moderating inflation, the cumulative price increases of recent years have devastated household purchasing power. Food prices remain elevated, and essential services like healthcare and education are increasingly unaffordable for many.

Unemployment: Official unemployment statistics understate the crisis. Youth unemployment and underemployment are particularly acute, creating potential for social instability.

Regional Inequalities: Development disparities between regions fuel perceptions of marginalization and inequitable resource distribution, complicating national cohesion efforts.

Election Pressures: The 2027 general elections will inevitably influence economic policy, with pressure for populist measures that may conflict with reform momentum.

External Vulnerabilities

Despite improved reserves and current account projections, Nigeria remains vulnerable to external shocks:

- Capital flow volatility: Portfolio inflows are volatile; any global risk-off sentiment can sap liquidity despite CBN support

- Commodity price swings: Beyond oil, Nigeria is exposed to prices for food imports and other commodities

- Global economic slowdown: Major trading partner recessions would reduce export demand

- Debt sustainability: While current debt-to-GDP ratios are manageable, debt service costs consume substantial revenue, limiting fiscal space

Business Sentiment: From Skepticism to Cautious Optimism

Business confidence surveys conducted in late 2025 reveal a meaningful shift in private sector expectations. After years of pessimism, more businesses now anticipate:

- Further naira appreciation or stability

- Improved operating conditions

- Gradual expansion opportunities

- Better access to foreign exchange

- More predictable policy environment

This psychological shift—from crisis management to growth planning—may prove as consequential as the measurable economic improvements. When businesses begin investing and hiring based on positive expectations, they create self-reinforcing growth dynamics that can sustain expansion beyond the initial policy stimulus.

However, this optimism is conditional and fragile. Businesses remain watchful for policy consistency, security improvements, infrastructure development (especially electricity), and continuation of reform momentum through the political cycle.

Strategic Policy Priorities for Sustained Progress

Immediate Priorities (2026)

1. Electricity Supply Reform and Investment

Nigeria's electricity challenge represents perhaps the single greatest constraint on economic activity. The country of 235 million people has an installed generation capacity of less than 13,000 megawatts—grossly inadequate for industrial development or decent living standards.

Priority actions include: - Complete power infrastructure projects already underway - Finalize electricity sector reforms and privatizations - Support distributed renewable energy deployment (solar, wind) - Reduce distribution losses and improve collections - Enable competitive retail electricity markets

2. Tax Reform Implementation

The success of the tax reforms depends entirely on effective implementation: - Deploy digital infrastructure across all states - Train tax officials and taxpayer service personnel - Conduct comprehensive public awareness campaigns - Establish effective dispute resolution mechanisms - Coordinate federal, state, and local revenue authorities - Monitor compliance and adjust systems based on early results

3. Infrastructure Investment Acceleration

Nigeria's $3 trillion infrastructure gap constrains every aspect of development: - Prioritize roads, rail, and ports for economic connectivity - Invest in water supply and sanitation - Modernize telecommunications infrastructure - Develop special economic zones with world-class infrastructure - Leverage public-private partnerships and development finance

4. Security and Conflict Resolution

Economic development is impossible without security: - Intensify military and police operations against insurgents, bandits, and criminals - Invest in intelligence and surveillance capabilities - Address root causes including poverty, marginalization, and governance failures - Pursue reconciliation and dialogue alongside kinetic operations - Engage communities in security through local policing initiatives

5. Social Protection Enhancement

Cushioning the impact of reforms on vulnerable populations is both morally imperative and politically essential: - Expand conditional cash transfer programs - Subsidize essential healthcare and education for the poor - Implement school feeding programs - Support agricultural inputs for small farmers - Create public works programs for employment generation

Medium-Term Imperatives (2026-2028)

1. Economic Diversification

Develop comprehensive industrial policy supporting manufacturing, agriculture, and services: - Identify sectors with competitive advantage and job creation potential - Invest in enablers: infrastructure, electricity, skills, financial access - Leverage African Continental Free Trade Area (AfCFTA) to access regional markets - Support export-oriented industries through targeted incentives - Develop special economic zones and industrial clusters

2. Strengthen Institutions and Governance

- Deepen anti-corruption efforts with tangible prosecutions and asset recovery

- Improve public financial management and budget execution

- Strengthen regulatory quality and reduce bureaucratic obstacles

- Enhance transparency and accountability across government

- Support independent judiciary and enforcement agencies

3. Invest in Human Capital

Nigeria's greatest asset is its young population—but only if properly educated and healthy: - Reform education to improve quality and relevance - Expand vocational training aligned with labor market needs - Improve healthcare access and quality - Address malnutrition and early childhood development - Support technical education and STEM fields - Expand scholarship programs for tertiary education

4. Build Resilience to Shocks

- Develop climate adaptation strategies for agriculture and coastal areas

- Diversify export basket beyond oil and primary commodities

- Strengthen financial sector stability and consumer protection

- Establish sovereign wealth fund mechanisms to manage commodity revenue volatility

- Create strategic reserves for essential commodities

Long-Term Vision (Beyond 2028)

Nigeria's ultimate goal should be transforming from a resource-dependent economy to a diversified, industrialized nation providing decent livelihoods for its rapidly growing population. This requires:

Economic Structure: A balanced economy where manufacturing, services, and technology contribute significantly alongside agriculture and extractives, generating quality jobs at scale.

Social Outcomes: Dramatic poverty reduction, expanded middle class, universal access to quality education and healthcare, and significantly reduced inequality.

Governance: Accountable, efficient institutions delivering public services effectively, with strong rule of law and citizen participation in governance.

Regional Integration: Leadership in African economic integration, serving as a manufacturing and services hub for West Africa and beyond.

Global Positioning: Recognition as an upper-middle-income country playing a significant role in global economic and political affairs.

Achieving this vision requires sustained commitment beyond individual administrations or political cycles—a national consensus on development priorities that transcends partisan competition.

Conclusion: Cautious Optimism, Determined Action

As Nigeria navigates 2026, the economic narrative contains grounds for both optimism and concern. The stabilization achieved in 2025—lower inflation, positive growth, improved external position, strengthening naira—demonstrates that sound policies can yield results even in a challenging environment. The comprehensive tax reforms, if implemented effectively, could transform revenue mobilization while providing meaningful relief to ordinary citizens and small businesses.

The data points tell a story of tentative progress: - GDP growth accelerating from 3.98% to projected 4.2–4.5% - Inflation moderating from 18% to 14.45% and projected further to ~13% - External reserves rebuilding from $44.67 billion to $45.6 billion and projected toward $51 billion - Naira stabilizing around ₦1,420–₦1,450/$ - Current account shifting from deficit to projected $17.7 billion surplus

Yet stability is not prosperity, and growth statistics mask persistent human suffering. With nearly two-thirds of Nigerians in poverty, millions displaced by conflict, unemployment at crisis levels, and basic services like electricity remaining unreliable, the development challenge remains immense. The gap between macroeconomic indicators and lived experiences creates a fragile political economy where technocratic policy successes may not translate into political support or social stability.

The year ahead will test Nigeria's capacity for: - Disciplined policy implementation through the election cycle and inevitable pressures for populist deviation - Inclusive growth strategies that ensure benefits reach beyond elite circles - Resilience in the face of inevitable oil price volatility, security incidents, and external shocks - Sustained political will to maintain reforms when implementation challenges mount - Social cohesion amid diversity, inequality, and regional tensions

The foundation has been laid. The question now is whether Nigeria's leaders, institutions, and citizens can build upon it to create an economy that works for all its people. The coming months will provide crucial evidence about whether 2026 marks a genuine turning point or merely a temporary respite in a longer struggle for economic transformation.

The stakes could not be higher. With Africa's largest population, massive natural and human resources, and strategic importance to regional stability, Nigeria's success or failure has implications far beyond its borders. The world is watching. More importantly, 235 million Nigerians are hoping—for jobs, security, opportunity, and a better future for their children.

2026 will reveal whether that hope is justified.

Sources and Data References

Primary Data Sources

National Bureau of Statistics (NBS) - GDP Q3 2025 report: https://punchng.com/nigerias-gdp-grows-3-98-as-services-agriculture-strengthen/ - CPI November 2025: https://businessday.ng/news/article/nigerias-inflation-ease-to-14-45-in-november/; https://von.gov.ng/nigerias-inflation-rate-falls-to-14-45-in-november-2025-nbs/

Central Bank of Nigeria (CBN) - Inflation time series: https://www.cbn.gov.ng/rates/inflrates.html - 2026 Economic Outlook: https://bizwatchnigeria.ng/cbn-forecasts-inflation-to-fall-to-12-94-in-2026-on-cheaper-food-and-fuel-prices/ - External reserves projection: https://punchng.com/fx-reserves-to-hit-51bn-by-2026-cbn/ - Monetary Policy Committee Communiqués and Statistical Bulletins (2025-2026)

External Reserves Data - TradingEconomics: https://tradingeconomics.com/nigeria/foreign-exchange-reserves - DailyTrust year-end summary: https://dailytrust.com/external-reserves-close-2025-at-45-49bn/ - BusinessDay FX inflows: https://businessday.ng/news/article/dollar-inflows-rise-38-in-december-as-cbn-boosts-market-liquidity/

Exchange Rate Data - BusinessDay reports: https://businessday.ng/business-economy/article/naira-records-first-weekly-gain-of-n7-68-in-new-year/ - Gistreel daily rates: https://www.gistreel.com/naira-to-dollar-official-black-market-rates-today-january-2-2026/; https://www.gistreel.com/naira-to-dollar-official-black-market-rates-today-friday-january-9-2026/ - MarketNewsNG: https://marketnewsng.com/2026/01/07/naira-strengthens-by-7-5-in-2025-hits-n1419-at-official-market/ - DailyTimes NG: https://dailytimesng.com/naira-weakens-at-official-window-as-2026-fx-outlook-firms-up/

Budget and Policy Documents

2026 Budget - Presidential budget speech (full text): https://dailypost.ng/2025/12/19/tinubus-2026-budget-speech-full-text/ - Senate framework approval: https://punchng.com/senate-lowers-oil-benchmark-approves-n54-46tn-budget/ - Budget risks analysis: https://www.icirnigeria.org/nigerias-2026-budget-threatened-as-oil-price-falls-to-60-below-proposed-benchmark/ - Federal Ministry of Finance, Budget and National Planning: 2026 Budget Documents and Economic Projections

Tax Reform Documentation - FiscalReforms.ng: Official tax reform documentation and guidance materials

Sector-Specific Analysis

Oil Sector - NUPRC production data: https://businessday.ng/energy/article/nigerias-oil-output-fell-6-to-1-6mbpd-in-november-nuprc/ - Production analysis: https://punchng.com/oil-output-averages-1-46mbpd-below-opec-benchmark/ - Dangote Refinery operations: https://www.hydrocarbonprocessing.com/news/2026/01/nigerias-dangote-oil-refinery-says-fuel-supply-intact-amid-maintenance/; https://www.naijanews.com/2026/01/05/dangote-refinery-assures-nigerians-of-steady-fuel-output/; https://www.spglobal.com/energy/en/news-research/latest-news/crude-oil/121225-nigerias-dangote-refinery-begins-turnaround-to-stabilize-operations-executive

External Account Projections - CardinalStone analysis: https://www.thetimes.com.ng/2026/01/nigerias-external-account-set-for-17-7-billion-surplus-in-2026-analysts/ - CBN current account projections: https://verilynews.com/cbn-projects-nigerias-current-account-surplus-to/ - DailyTrust reserves analysis: https://dailytrust.com/analysts-weigh-in-on-51bn-reserve-12-94-inflation-projections/

Institutional Research and Analysis

Research Firms - Norrenberger GDP analysis: https://norrenberger.com/wp-content/uploads/2025/12/Economic-Flash-GDP-Q3-2025.pdf - Meristem macroeconomic update: https://research.meristemng.com/reports/wp-content/uploads/2025/12/Macroeconomic-Update-GDP-Report-_-Q3-2025.pdf - PwC Nigeria: "Economic Outlook 2026" (December 2025) - CardinalStone Partners: "2026 Nigeria Macroeconomic Outlook" (December 2025)

International Institutions - International Monetary Fund: "Regional Economic Outlook: Sub-Saharan Africa" (October 2025) - Fitch Ratings: "Nigeria Credit Rating and Economic Outlook" (2025) - World Bank: Nigeria Development Update reports

Media Sources

Extensive reporting from Nigerian media outlets including The Guardian, Punch, Vanguard, Premium Times, BusinessDay, ThisDay, Nairametrics, DailyTrust, and others (various articles, 2025-2026).

Data Methodology Note

This analysis synthesizes information from multiple sources to provide comprehensive coverage. Where projections differ across institutions, ranges or multiple estimates are provided. Economic data points have been cross-referenced across sources to ensure accuracy. Exchange rate data reflects market realities across official and parallel markets. All figures are subject to revision as new official data becomes available.

About N-Circular

N-Circular (ncircular.org) provides independent, data-driven analysis of Nigerian economic, political, and social developments. We aggregate news from multiple sources and produce original analytical content to help readers understand the forces shaping Nigeria's future.

Contact: For questions, corrections, or additional information, visit ncircular.org

Disclaimer: This analysis is for informational purposes only and does not constitute financial, investment, or policy advice. Readers should conduct their own research and consult appropriate professionals before making decisions based on this information.

Copyright © 2026 N-Circular. All rights reserved.

Licensed under Creative Commons Attribution-NonCommercial 4.0 International (CC BY-NC 4.0). You may share and adapt this material for non-commercial purposes with appropriate attribution.